Contract risk assessment has long been a legal function, essential for protecting organizations from legal and compliance risks. Today, the process has evolved through LegalTech tools, such as automated risk detectors.

Key Insights

- Automation is key to improving traditional contract risk assessment.

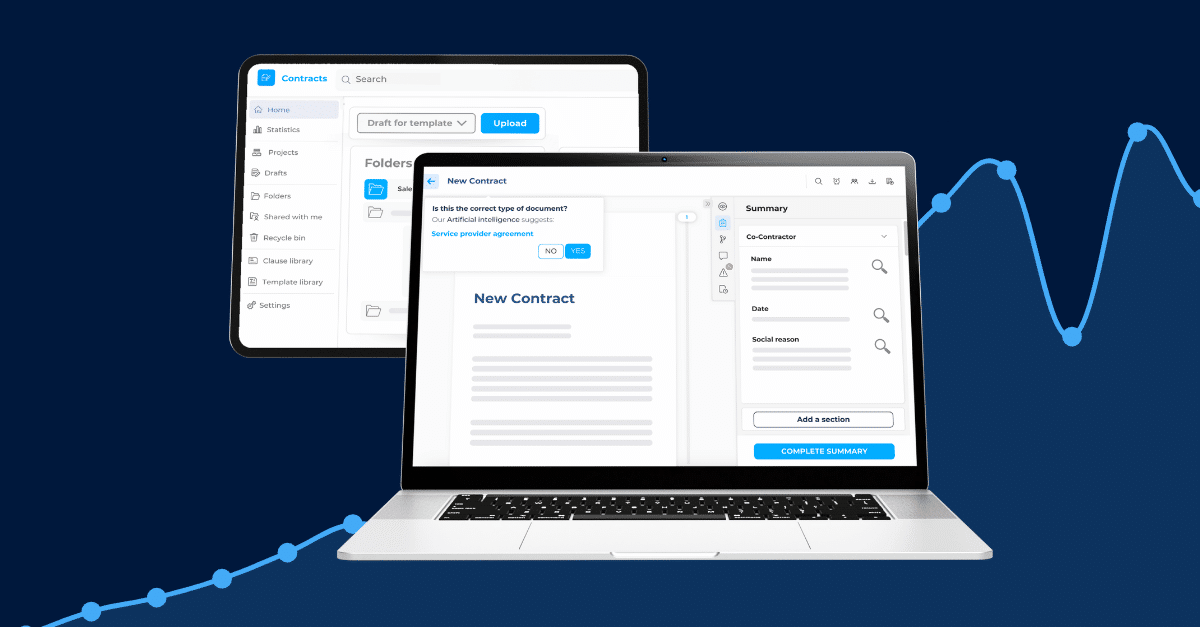

- Tools like a robust CLM can help with features that enable automated risk detection.

The times where legal teams relied on manual redlining to evaluate contract clauses and assess risks are long gone. Today, contract risk assessment has become an easier task than ever.

Identifying red flags in a contract isn’t exactly enough anymore, and doing so manually even less. Besides the waste of time on manual redlining, is also the fact that the task stops there. True protection means ensuring company-wide compliance, applying internal legal standards consistently, and creating traceable, auditable records of every change.

Luckily, many contract management solutions today enable automated contract risk assessment, some go even further. With recent features such as embedded risk detector within the chosen CLM tool, a contract review turns into a smart automated and policy-driven process.

Contract Risk Assessment in Short

Contract risk assessment is the process of evaluating a contract to identify, flag, and mitigate potential legal, financial, operational, or compliance risks before a document is executed. It’s a critical step in managing exposure and liability within an organization, and it can look different depending on the industry, company size, and organizational needs.

Although contract risk assessment sounds like a legal only task, it can actually concern other departments such as procurement or HR.

Common Risks

As previously mentioned, important and secondary risks vary depending on many factors. Nevertheless, below are some of the most common ones:

Limitations of the Traditional Contract Risk Assessment

Manual compliance review is a real burden, and while this method was widely used for years, it comes with its limitations.

Inconsistent reviews

Not all stakeholders interpret clauses the same way, especially if they’re not in the legal department. Since contracts contain sensitive clauses such as those related to NDAs or liabilities, it’s essential to work with legal consistency and avoid compliance set-backs.

Slow analysis process

In a world where legal is too often perceived as a blocker, contract risk assessment needs to keep up with the speed of business. Manual clause reviews and redlining can slow down the entire contract lifecycle, ultimately affecting productivity and frustrating end-users.

Lack of traceability

Is there something worse than trying to track back who approved a problematic clause? Or who signed off a non compliant contract? Old contract risk assessment methods lack of visibility and usually leave documents scattered. It poses major challenges both legally and operationally.

Over-dependence on legal teams

Over-dependence on legal teams causes serious bottlenecks, as business units are unable to confidently assess contracts on their own. This can happen even with the most standard templates like NDAs or procurement agreements.

The result? Contract risk assessment becomes a reactive exercise, focused on fixing errors after the fact, rather than enforcing proactive compliance from the start.

Risk Detectors Are the New Standard for Contract Risk Assessment

Nowadays many LegalTech providers offer automated contract risk detection. A feature of this nature flips around the traditional risk analysis model for in-house legal teams.

But how does a risk detector work? How exactly will it enhance overall company contract risk assessment? Although we speak about automatic clause and risk detection, there is a human factor in defining it.

Contract Playbooks at the Core of Contract Risk Assessment

In many cases, legal teams and contract managers will be tasked to carefully craft contract playbooks. A contract playbook will simply establish the key terms and conditions attached to contract types, clauses to flag, custom compliance rules and other guidelines.

For instance, let’s take the case of commercial lease agreements. These agreements usually hold several specificities so in your “Lease agreement” playbook you may add guidelines such as:

This structured approach ensures consistency across every contract, no matter who reviews it. To top it, more and more solutions embed AI features within contract risk assessment capabilities.

When AI Steps In

Artificial Intelligence has stepped in our daily personal and professional lives, this includes contract management too. When it comes to recognizing and flagging contractual risks, AI can look different ways.

A proper CLM with a robust contract risk assessment feature will:

Beyond these valuable insights, AI-powered tools also bring a major advantage: clear audit trails. They offer real-time change tracking, often down to the detail of who last reviewed, modified, or approved a modification.

The Future of Contract Risk Assessment is Automated

Modern contract risk assessment isn’t just about identifying what’s wrong but about ensuring the entire contract lifecyle aligns with internal policies. By embedding compliance rules directly into the review process, the task becomes easier for everyone. Legal and business teams to work faster and with greater confidence, from first draft to final approval.

The key innovation lies in traceability. Each accepted or rejected clause is recorded, enabling audit-ready documentation and verifiable compliance. Teams can revisit and re-analyze contracts as needed, ensuring no critical detail is overlooked. With these capabilities, contract reviews become not only more efficient, but also more defensible.