Cathay Capital, Eurazeo via its Small-Mid Buyout [1] team and Sagard NewGen have signed an exclusivity agreement with a view to investing in DiliTrust alongside its management team led by Yves Garagnon and Nadim Baklouti.

Under the agreement, the consortium of investors would become the group’s core shareholder by investing more than €130 million, of which Eurazeo would invest €52 million. Calcium Capital, which has been a financial investor in DiliTrust since 2017, is selling all of its stake.

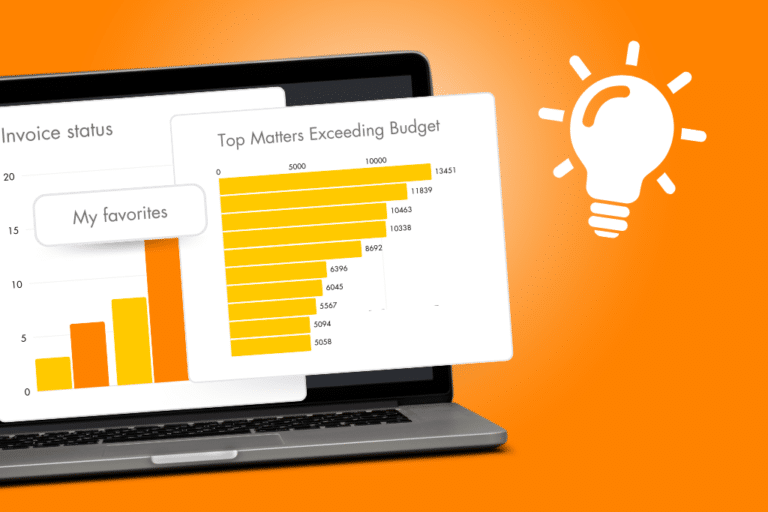

With the DiliTrust Governance Suite, DiliTrust offers a unified and secure platform, composed of different modules to meet the growing digitalization needs of legal departments and governance bodies of large corporates, SMEs and public entities. The SaaS editor supports more than 2000 organizations in their efforts to automate processes, improve performance and protect their strategic and sensitive data. DiliTrust enables them to achieve these objectives, notably through a board portal for managing board meetings, as well as modules for managing legal entities and managing contracts and litigations.

In 2021, the group, which employs more than 160 people worldwide, achieved a turnover of nearly 20 million euros, half of which was generated internationally, with an increase of around 30% per year in recent years. Already present in France, Canada, Italy, the Middle East and Africa, DiliTrust has also strengthened its presence in Spain and expanded its operations in Latin America following the acquisition of Gobertia last year.

DiliTrust is continuing to expand by gaining new clients in France and abroad, and it intends to complement this expansion with an active buy-and-build strategy, with the support of its new financial partners. Cathay Capital, Eurazeo, Sagard NewGen and DiliTrust’s management team intend to leverage the company’s best-in-class skillset, strong reputation and robust underlying market growth in order to achieve their shared ambition of accelerating DiliTrust’s growth and build a global leader in legal and governance solutions.

Yves Garagnon, CEO of DiliTrust, said:

“The need to digitize and secure the most sensitive corporate data is growing. We have a robust suite that fully meets these challenges, particularly for boards of directors and legal departments. We are recognized for the ease of use and performance of our suite and are identified as one of the world’s leading players by major analysts such as Gartner. We are delighted with the confidence placed in us by this consortium of investors.”

Jérémie Falzone, Partner at Cathay Capital, Benjamin Hara, Member of Eurazeo Mid Cap’s Executive Board and Guillaume Lefebvre, Partner at Sagard NewGen said:

“We are very happy to support DiliTrust and its management team led by Yves Garagnon with the ambition of creating a global leader in governance solutions. The Enterprise Legal Management software market is growing rapidly, in line with the general acceleration in the take-up of LegalTech solutions. DiliTrust is a leading player in this market with an integrated software suite that has won over a number of top-tier clients. We are excited about the prospect of bringing the international business networks, sector expertise and active support of Cathay, Eurazeo and Sagard to help DiliTrust achieve its ambitious strategy, based on a combination of organic growth and acquisitions.”

Cédric Duchamp, Managing Partner at Calcium Capital, said:

“We are proud of the achievements since 2017, working alongside DiliTrust and its management team led by Yves Garagnon. The company has demonstrated an outstanding ability to anticipate key market trends and to meet the needs of the most demanding clients. We are delighted to see Cathay, Eurazeo and Sagard team-up to continue the work with DiliTrust in the next phases of acceleration of its development.”

PARTICIPANTS to the transaction:

- Cathay Capital: Jérémie Falzone, Felix Wang, Marion Prieur

- Eurazeo: Benjamin Hara, Clément Morin, Claire Berthoux, Bastien Estival, Cécile Gilliet

- Sagard NewGen: Guillaume Lefebvre, Agnès Huyghues Despointes, Martin Klotz

- Calcium Capital: Cédric Duchamp, Antoine Gravot

- Financial advisors: Bryan Garnier & Co (Thibaut de Smedt, Stanislas de Gmeline, Jonathan Bohbot) and Natixis Partners (Nicolas Segretain, Romain Etienne)

- Legal advisors: Hogan Lovells (Stéphane Huten, Pierre-Marie Boya) and McDermott Will & Emery (Grégoire Andrieux)

- Financial due diligence: Eight Advisory (Stéphane Vanbergue, Victor Heilweck) and Alvarez & Marsal (Jonathan Gibbons, Samih Hajar)

- Strategic due diligence: Roland Berger (Cyrille Vincey, Mouhsine Aguedach) and Kearney (Julien Vincent, Hadi Benkirane, Hugo Khelifa)

- Legal, fiscal and social due diligence : Hogan Lovells (Stéphane Huten, Pierre-Marie Boya)

- IT due diligence: Make it Work (Frédéric Thomas), EPAM (Philippe Trichet, Neil Holton) and I-Tracing (Michel Vujicic)

- Seller financial advisors: Macquarie Capital (Fady Lahame, Guillaume Basini)

- Seller legal advisors: FTPA (Bruno Robin, Charles-Philippe Letellier) and Viguié Schmidt et Associés (Fabrice Veverka)

- Seller financial due diligence: PwC (Philippe Serzec, Manil Bengana)

- Management advisor: Axance Finance & Development (Antoine Rimpot)

About DiliTrust

- As a SaaS solution provider for over 25 years, DiliTrust offers its DiliTrust Governance suite dedicated to corporate governance and the secure sharing of sensitive and confidential data. This unified and ultra-secure platform is designed for legal departments and governance bodies. It includes various complementary modules, notably for the digitization of boards and committees, the management of legal entities, contracts, litigation and disputes.

- DiliTrust has more than 2,000 customers in some 50 countries. Major groups in Europe, North America, Africa and the Middle East trust DiliTrust, including: Almarai, AccorHotels, Ecobank, Royal Bank of Canada, BNP Paribas, Bouygues, Caisse de Dépôt et de Gestion du Maroc, Campari, Capgemini, Carraro, Commercial Bank of Dubai, Desjardins Capital, EDF, Engie, Eutelsat, Geox, Ingenico, Koç, Loto-Quebec, LVMH, Luxempart, Renault, Groupe Robert, SNCF, Société Générale, Transports de Montréal, Tereos, UNICEF, Veolia, City of Montreal and Vivendi

- https://www.dilitrust.com/

- PRESS CONTACT: Tahiana Tissot (tahiana.tissot@dilitrust.com)

About Eurazeo

- Eurazeo is a leading global investment company, with a diversified portfolio of €31 billion in assets under management, including €22 billion on behalf of third parties, invested in over 450 companies. With its considerable private equity, private debt, real estate and infrastructure expertise, Eurazeo accompanies businesses of all sizes, supporting their development through the commitment of its nearly 360 professionals and offering in-depth sector expertise, a gateway to global markets, and a responsible and stable foothold for transformational growth. Its solid institutional and family shareholder base, robust financial structure free of structural debt, and flexible investment horizon enable Eurazeo to support its companies over the long term.

- Eurazeo has offices in Paris, New York, London, Frankfurt, Berlin, Milan, Madrid, Luxembourg, Shanghai, Seoul, Singapore and Sao Paulo.

- Eurazeo is listed on Euronext Paris.

- ISIN: FR0000121121 – Bloomberg: RF FP – Reuters: EURA.PA

- eurazeo.com

- PRESS CONTACT: Maël Evin, Havas (evin@havas.com)

About Cathay Capital

- Cathay Capital Group is a global investment firm supporting companies at all stages throughout North America, Asia, Europe and Africa. By helping navigate the opportunities of globalization and sustainable transformation, Cathay is the partner of choice for companies aspiring to lead markets and make a positive impact. Its global platform connects people – from investors and entrepreneurs to management teams and leading corporations – across continents to share knowledge, the tools to scale, and achieve the extraordinary. Founded in 2007 with a strong entrepreneurial heritage, Cathay Capital now manages more than $4.2 billion in assets, has completed over 220 investments with the global reach and local expertise of its offices in Paris, Munich, New York, San Francisco, Shanghai, Shenzhen, Beijing and Singapore.

- cathaycapital.com

- PRESS CONTACT: Yoann Besse, Citigate Dewe Rogerson (besse@citigatedewerogerson.com)

About Sagard NewGen

- Sagard NewGen aims to support the development of leaders in the healthcare and technology sectors. The fund was established to make majority and minority equity investments, financing the growth strategy of profitable European companies that share its commitment to innovation and sustainability (revenues of up to €150 million).

- Sagard NewGen extends the international platform’s European base alongside Sagard MidCap and Portage Venture. Sagard NewGen provides management teams with bespoke support and a high value-added ecosystem that has truly international reach through its presence in Europe, North America and Asia.

- Sagard has offices in Paris, Montreal, Toronto, New York, San Francisco and Singapore.

- sagard.eu

- PRESS CONTACT: Lucie Wallet, (wallet@sagard.com)

About Calcium Capital

- Calcium Capital brings together the capital of entrepreneurs, managers and families who wish to invest in attractive SMEs while giving them the benefit of their experience and network. Calcium Capital’s mission is to take equity stakes of between €5m and €20m in promising companies for which it aims to be an active shareholder with high added value.

- Calcium Capital has a diverse and complementary team of investors and partners who are committed to the long-term viability of companies, while respecting their culture and values.

- calciumcapital.com

- PRESS CONTACT: Cédric Duchamp (cd@calciumcapital.com)