In their day-to-day business, companies face a wide range of legal risks. Legal risk refers to any uncertainty that could lead to negative consequences for the company such as lawsuits, fines and other sanctions. In this article, discover the main legal risks faced by companies, as well as 5 tips for better management.

What are the different types of legal risks?

Legal status risks

The choice of a company’s legal status is made at the time of its establishment and concerns a governance structure. Depending on the legal status chosen, tax, operational, managerial and even documentary management of the structure will not be the same. Throughout the life of the company, the legal department must ensure that practices relating to its status are respected, particularly to prevent fraud.

Risks related to assets

All of the company’s assets present their own legal risks. The term ‘assets’ refers to both human capital and intellectual property, grouped under the term intangible assets; on the other hand, the building itself and its equipment are considered tangible assets.

Risks related to contracts

Companies often handle large quantities of contracts, which represent a significant legal but also financial risk. These risks can relate to the compliance of clauses and provisions, the fulfillment of contractual obligations, or even the respect of deadlines. Hence the importance of well-managed contract management, without error or omission.

Read also: What Are the Main Challenges of Contract Management?

Risks related to disputes

A dispute is a disagreement between two or more people, which can lead to the filing of a complaint, which can lead to litigation. The most common disputes that companies face relate to product liability, professional misconduct, or accidents. These conflicts are time-consuming, generate a significant financial risk, and often harm the company’s reputation. The legal department must intervene in the disputes themselves but also prevent them ahead of time, by defining the risks and providing for risk transfer agreements.

Regulatory Risks

All companies are subject to a set of standards and regulations, which are generally specific to their sector of activity. These regulations are issued by public institutions or administrations and are subject to frequent changes, which must be closely monitored and even anticipated by legal departments. A company’s non-compliance with the regulations that concern it can generate some disputes and penalties. For example, the company may have to pay a fine or find itself unable to carry out its activity.

What is a legal risk map?

Legal risks are numerous and varied, and must be subject to constant vigilance by legal departments. To facilitate the management of these risks, it is essential to implement efficient tools and methods, starting with a comprehensive map.

The mapping of legal risks is a methodology that consists of identifying, prioritizing and assessing the legal risks to which your company is exposed. Its main objective is to have an overall view of these different risks, to better anticipate them. Prioritization is another important element, which allows the legal department and other involved departments to prioritize their actions. A true strategic tool, this map should be communicated to all the company’s departments. While the legal department manages legal risk, it is implemented by all employees in their daily tasks (sales, purchasing, finance and accounting, human resources…).

The map is developed by assigning each legal risk a score corresponding to its potential impact. This score, often quantified, can be calculated or assigned based on several criteria: legal risk, reputational risk, not to mention potential financial losses. In any case, the goal is to produce one or more common, readable and evolving documents, accessible to all concerned employees.

5 ways to manage your legal risks with the DiliTrust Governance suite

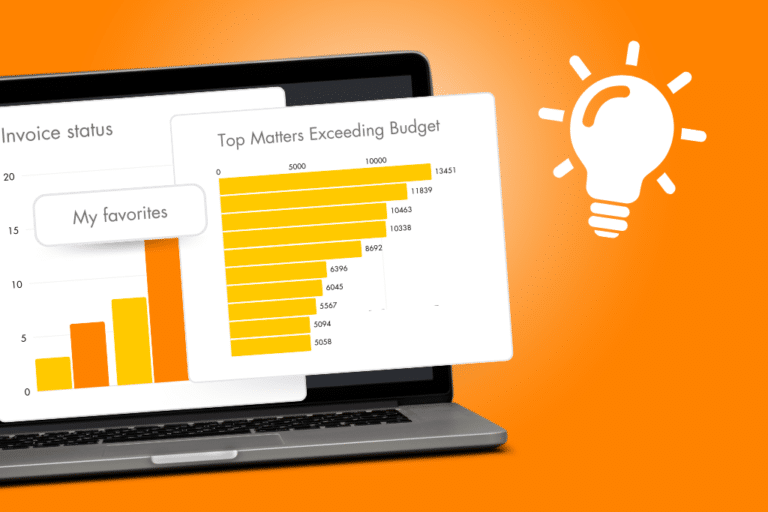

The DiliTrust Governance suite includes a range of solutions for legal services. These complementary modules cover all the legal risks of your company, for optimized and strengthened management.

Legal Status

To manage the obligations related to your company’s governance structure, DiliTrust mainly relies on the Board Portal module, as well as its Legal Entities module. Through secure and dematerialized collaborative spaces, these modules allow for centralizing sensitive data, and maintaining a global view of the activities of your governance bodies, even in the case of multiple subsidiaries. A significant boost in terms of time, productivity, but also security and compliance.

Assets

To keep an overview of the risks related to your company’s assets, DiliTrust has an automated contract management module. This module allows you to centralize all your contracts in a single database, and to simplify daily management of these wherever you are. Thanks to an alert system, you will not miss any deadlines, tacit renewals or modifications, which significantly reduces risks.

Read also: Securing Corporate Boards: Multiple Factor Authentication as a Crucial Measure

Contracts

DiliTrust’s contract lifecycle management (CLM) module is specifically designed to reduce risks related to contracts. Automated management is essential for a certain volume of contracts, at the risk of costly inaccuracies, particularly regarding dates, clauses and other key elements such as compliance. Stored in a fully secure database, contracts are strictly managed throughout their lifecycle from: drafting, validation, signing and monitoring.

Disputes

Thanks to the Litigation module, all your files are centralized in one space, with an intuitive interface. This module structures and simplifies the management of disputes, which represents a real advantage in terms of image improvement towards stakeholders. The software also takes into account the financial aspect, by allowing it to anticipate and reduce risks.

Regulations

The regulatory compliance of a company essentially involves the compliance of its contracts, which must be updated with each change in standards and regulations. The CLM tool facilitates this aspect of compliance, with the smart search tool that allows it to quickly update all concerned contracts.

Additionally, the DiliTrust suite complies with laws and regulations on data protection, particularly GDPR. DiliTrust also benefits from ISO 27001 and ISO 27701 certifications, which guarantee the integrity of the personal data of its clients.

The management of a company’s legal risks involves numerous and varied actions related to contracts, disputes, but also assets and governance bodies. For optimal management, companies can equip themselves with intelligent and secure tools like the DiliTrust suite, which covers all aspects of reducing legal risks.

Curious about our product’s functionalities and its ability to mitigate legal risks? Get in touch with us today.