A holding company is a strategic corporate structure designed to own and control assets or subsidiaries rather than conduct business operations itself. By separating ownership from day-to-day activities, holding companies offer advantages such as asset protection, tax efficiency, and centralized control across multiple entities. While they provide risk isolation and facilitate complex corporate management, holding companies also face regulatory scrutiny and governance challenges. Leveraging digital governance tools can streamline multi-entity administration, ensuring compliance and transparency. Overall, holding companies empower businesses to optimize structure, safeguard assets, and enable scalable growth.

A holding company represents one of the most strategic corporate structures in modern business. This specialized business entity exists primarily to own assets, including controlling shares in other companies, rather than conducting operations itself. For businesses seeking to optimize their corporate structure, understanding how holding companies function provides valuable insights into asset protection, tax efficiency, and streamlined management.

What Is a Holding Company?

A holding company is a business entity that owns outstanding stock in other companies. Unlike operating companies that produce goods or deliver services, a holding company’s primary purpose centers on owning assets and controlling subsidiary businesses. The parent-subsidiary relationship forms the foundation of this structure, with the holding company maintaining control through ownership of voting stock.

The distinction between holding companies and operating companies lies in their fundamental purpose. While operating companies engage directly in business activities, holding companies focus on ownership and control. This separation creates a protective barrier between assets and operational risks.

For example, a holding company might own multiple retail brands, real estate properties, and intellectual property rights without directly managing day-to-day store operations.

Types of Holding Companies

Holding companies come in several forms, each serving different business objectives:

Pure vs. Mixed Holding Companies

Pure holding companies exclusively own assets in other businesses without conducting any operations themselves. They generate income solely through dividends, interest, and appreciation of owned assets.

Mixed holding companies both own subsidiaries and conduct their own business operations. This hybrid approach allows for diversified income streams while maintaining control over related businesses.

Financial Holding Companies

These specialized entities own controlling interests in financial institutions such as banks, insurance companies, and investment firms. In the United States, financial holding companies operate under specific regulatory frameworks established by the Federal Reserve.

Family Holding Companies

Created to manage family wealth across generations, these structures help preserve assets, minimize estate taxes, and maintain control of family businesses through centralized ownership.

Advantages of Creating a Holding Company

Establishing a holding company offers numerous strategic benefits for businesses:

Asset Protection and Risk Isolation

One of the primary advantages of a holding company structure is the ability to isolate risks. By separating valuable assets from operational activities, businesses protect their core holdings from potential liabilities. If one subsidiary faces legal challenges or financial difficulties, the assets held by the parent company remain protected.

Tax Benefits and Optimization

Holding companies provide opportunities for tax efficiency through:

Centralized Control with Decentralized Operations

This structure enables centralized strategic decision-making while allowing subsidiaries to maintain operational independence. The holding company sets overall direction and allocates resources, while operating companies focus on their specific markets and business activities.

Potential Drawbacks to Consider

Despite their advantages, holding companies present certain challenges:

Increased Regulatory Scrutiny

Holding companies, particularly those with significant market influence, often face heightened regulatory oversight. This scrutiny requires robust compliance programs and transparent reporting practices.

Complexity in Corporate Governance

Managing multiple entities demands sophisticated governance frameworks. Each subsidiary requires appropriate board oversight, clear reporting structures, and aligned management incentives.

Additional Compliance Requirements

Operating across multiple jurisdictions increases compliance obligations. Holding companies must navigate various legal systems, tax regimes, and regulatory environments, necessitating comprehensive legal and accounting expertise.

How to Establish a Holding Company

Creating a holding company involves several key steps:

The process requires careful planning and typically involves collaboration between legal, tax, and financial advisors to ensure optimal structure.

Notable Holding Company Examples

Several prominent businesses operate as holding companies:

Legal and Governance Considerations

Effective management of holding companies requires robust governance practices.

Board Composition and Responsibilities

The board of a holding company bears responsibility for overseeing the entire corporate structure. This oversight includes:

Compliance with International Regulations

As holding companies often operate across borders, they must navigate complex international regulations. This includes adherence to anti-trust laws, foreign investment restrictions, and cross-border taxation rules.

Transparency and Reporting Obligations

Holding companies with public subsidiaries face additional disclosure requirements. Transparent reporting practices build trust with investors and reduce regulatory risks.

Managing Holding Companies Effectively

The complexity of holding structures creates unique management challenges.

Challenges in Multi-Entity Management

Coordinating activities across multiple legal entities requires sophisticated management systems. Information must flow efficiently between the parent company and subsidiaries while maintaining appropriate legal separations.

The Role of Technology in Holding Company Administration

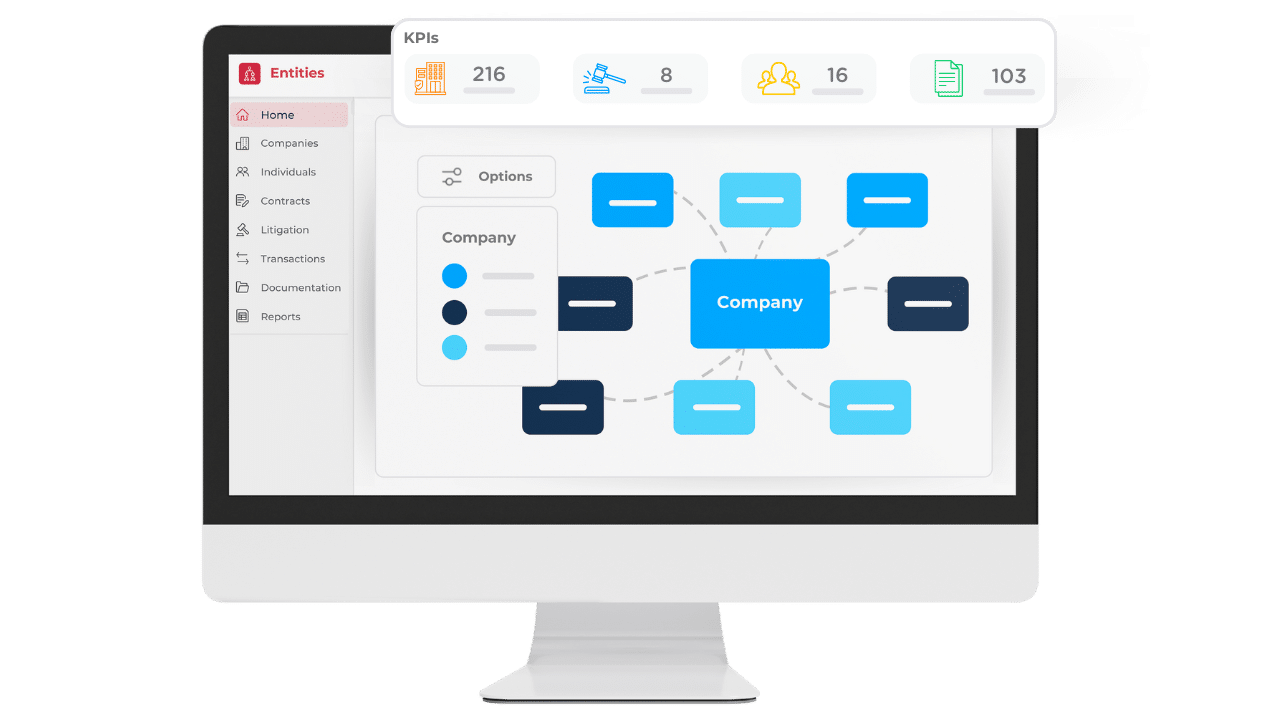

Digital governance solutions streamline holding company management through:

Specialized governance software helps legal teams maintain accurate records of corporate structures, ownership details, and director information across all entities within the holding company.

Benefits of Digital Governance Tools

For holding companies managing multiple subsidiaries, digital governance platforms offer significant advantages:

These tools transform what was once a labor-intensive process into an efficient, secure system for managing complex corporate structures.

The Strategic Value of Holding Companies

Holding companies represent more than just legal structures: they provide strategic frameworks for growth, protection, and optimization. When properly established and managed, they offer businesses powerful tools for:

For organizations seeking to optimize their corporate structure, the holding company model continues to demonstrate its value across industries and markets worldwide.

Strengthening Corporate Strategy Through Effective Holding Company Governance

Holding companies play a pivotal role in shaping corporate strategy, protecting assets, and enabling long-term growth. Their ability to centralize oversight while preserving operational flexibility gives organizations a scalable framework for expansion, risk management, and efficient capital allocation. However, the benefits of this structure depend on strong governance practices, transparent reporting, and consistent oversight across all subsidiaries.

As corporate groups become more global and more complex, maintaining accurate records, coordinating multi-entity workflows, and ensuring regulatory compliance require reliable, modern tools. Digital governance platforms provide the infrastructure needed to manage these responsibilities efficiently, offering centralized visibility, automated compliance monitoring, and secure board collaboration.

Organizations that adopt streamlined governance processes and technology-enabled oversight place themselves in a stronger position to respond to regulatory demands, support strategic decision-making, and sustain long-term value creation. For companies evaluating how to optimize or modernize their holding structures, strengthening entity governance is an essential step toward resilience and operational excellence.