A structured contract review checklist helps organizations minimize legal and financial risks by ensuring consistency, compliance, and thoroughness throughout the contract lifecycle. Leveraging collaborative processes and digital tools streamlines reviews and transforms contract management into a strategic business asset.

Contracts form the foundation of business relationships, yet inadequate reviews lead to significant risks. According to World Commerce & Contracting, companies lose approximately 9% of their annual revenue due to poor contract management. A structured contract review checklist serves as an essential tool for legal departments to mitigate risks, ensure compliance, and protect business interests.

This comprehensive guide outlines the critical elements of an effective contract review checklist, providing legal professionals and business teams with a framework to streamline their review process while maintaining thoroughness and accuracy.

Why Every Organization Needs a Contract Review Checklist

Contracts govern nearly every aspect of business operations, from vendor relationships to employee agreements. Without a systematic approach to reviewing these documents, organizations expose themselves to unnecessary risks and potential financial losses.

A well-designed contract review checklist offers multiple benefits:

- It ensures consistency across all agreements, regardless of who conducts the review

- It reduces the likelihood of overlooking critical clauses or terms

- It creates an audit trail for compliance and governance purposes

Additionally, a standardized checklist accelerates the review process, allowing legal teams to handle higher volumes of contracts without sacrificing quality. This efficiency becomes particularly valuable during periods of increased business activity or when resources are limited.

Essential Elements of a Comprehensive Contract Review Checklist

Before diving into the details of contract clauses and legal intricacies, it’s important to establish a structured approach. A well-rounded contract review checklist should cover all critical areas—ranging from basic identifying information to legal, financial, and performance-related terms.

1. Basic Contract Information

The first section of any contract review checklist should focus on verifying fundamental information. This includes:

- Parties involved: Confirm the legal names and addresses of all parties, ensuring they match corporate records. Verify the authority of signatories to bind their respective organizations.

- Contract purpose: Clearly understand the objective of the agreement and whether it aligns with business goals.

- Term and renewal: Check the effective date, duration, and renewal terms. Note whether renewals occur automatically or require notice.

- Signature requirements: Identify who needs to sign the document and in what capacity. Ensure all signature blocks are correctly formatted.

2. Legal Terms and Conditions

This section addresses the core legal framework of the agreement:

- Governing law: Identify which jurisdiction’s laws apply to the contract and whether this creates any compliance issues.

- Dispute resolution: Review how conflicts will be resolved, through arbitration, mediation, or litigation , and where proceedings would take place.

- Indemnification: Examine indemnity clauses to understand potential liability exposure and ensure they’re balanced between parties.

- Confidentiality: Assess provisions protecting sensitive information and verify they adequately safeguard company data.

- Intellectual property: Check who owns any IP created during the agreement and what rights each party has to use existing IP.

3. Financial Considerations

Financial terms require careful scrutiny to avoid unexpected costs:

- Payment structure: Review payment amounts, schedules, and methods. Look for clarity in invoicing procedures.

- Price adjustments: Identify any mechanisms allowing price increases and under what circumstances they apply.

- Expenses: Determine which party bears responsibility for various expenses and whether there are caps or approval requirements.

- Tax implications: Consider any tax consequences of the agreement, particularly for cross-border transactions.

4. Performance Obligations

Clear performance standards protect both parties:

- Deliverables: Verify that all products or services are described with sufficient detail to avoid misunderstandings.

- Timelines: Check that deadlines are realistic and include consequences for delays.

- Quality standards: Ensure the agreement specifies acceptable quality levels and how they’ll be measured.

- Reporting requirements: Review any obligations to provide progress reports or performance metrics.

5. Risk Assessment

Identifying potential risks helps prevent future problems:

- Termination rights: Examine the circumstances under which either party is allowed to end the agreement and the required notice period.

- Force majeure: Review provisions addressing unforeseeable circumstances and whether they adequately protect your interests.

- Insurance requirements: Confirm insurance obligations meet company standards and provide appropriate coverage.

- Regulatory compliance: Verify the contract addresses relevant industry regulations and compliance requirements.

To enhance risk identification and mitigation, organizations are able to leverage AI-powered tools like DiliTrust’s Risk Detector. This proprietary solution automatically flags non-compliant or high-risk clauses (deviations from standard termination rights, insurance obligations, regulatory references…) by applying internal compliance playbooks. It streamlines the review process by suggesting compliant alternatives, helping legal teams finalize agreements with greater speed and confidence.

Implementing an Effective Contract Review Process

A checklist alone isn’t enough – it must be part of a structured review process.

Pre-review Preparation

Before beginning the actual review, gather relevant information about the business relationship and objectives. Understanding the context helps identify potential issues that might not be apparent from the contract language alone.

Collaborative Approach

Contract reviews benefit from multiple perspectives. While legal teams focus on legal risks, business stakeholders should review commercial terms, and financial teams should examine payment provisions. This collaborative approach ensures all aspects receive appropriate attention.

Documentation and Communication

Document all findings, questions, and suggested changes. Clear communication between the review team and those negotiating with the other party prevents misunderstandings and ensures important issues are addressed.

Final Approval

Establish a clear approval workflow that includes sign-off from all relevant departments before finalizing the agreement.

Leveraging Technology for Efficient Contract Reviews

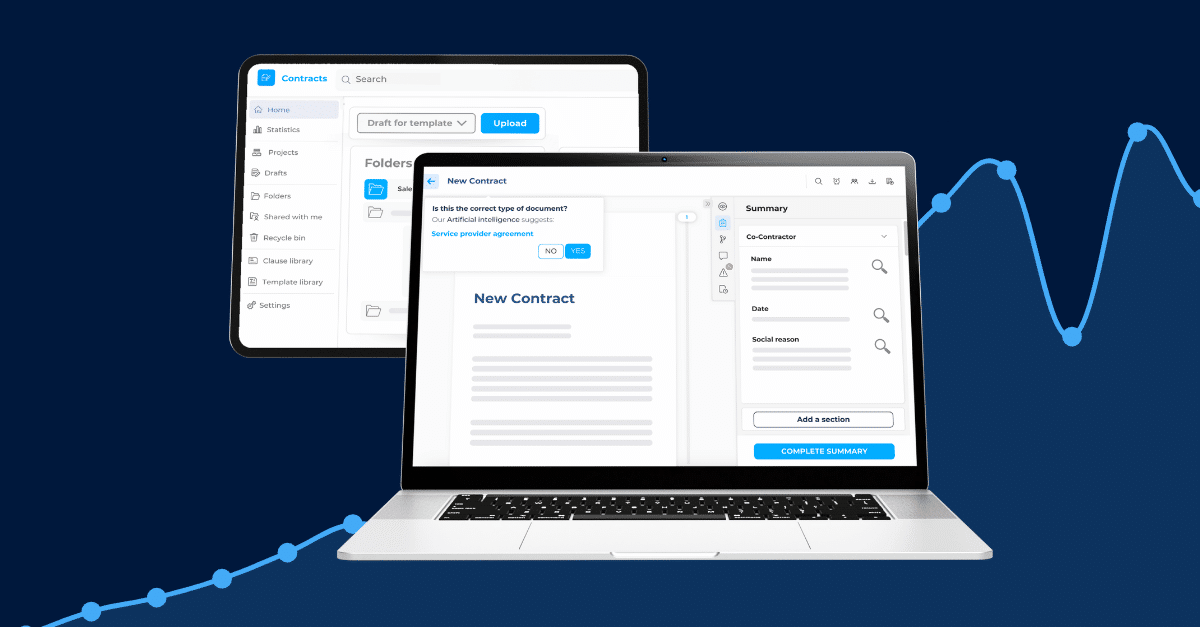

Modern contract management solutions transform the review process through.

Centralized Contract Repository

Digital platforms provide a secure, centralized location for storing all contracts and related documents, making them easily accessible to authorized team members.

Automated Workflows

Technology streamlines the review process by automatically routing contracts to appropriate reviewers and tracking progress through each stage.

AI-Powered Analysis

Advanced contract management systems use artificial intelligence to identify potential issues, inconsistencies, or missing clauses. This technology significantly reduces review time while improving accuracy.

Standardized Templates

Digital solutions offer standardized templates and clause libraries, ensuring consistency across all agreements and reducing the time needed to create new contracts.

The DiliTrust Suite provides comprehensive contract management capabilities, including automated workflows, secure document storage, and advanced analytics. These features enable legal teams to conduct thorough reviews efficiently while maintaining complete visibility throughout the contract lifecycle.

Turning Contract Review into a Strategic Asset

A systematic contract review checklist serves as an essential tool for legal departments and business teams alike. By addressing all critical elements – from basic information to complex legal and financial terms – organizations protect themselves from unnecessary risks while ensuring their agreements support business objectives.

Implementing a structured review process, supported by appropriate technology, transforms contract management from a potential bottleneck into a strategic advantage. This approach not only reduces risks but also accelerates business operations by streamlining approvals and providing greater visibility into contractual relationships.

For organizations seeking to enhance their contract management capabilities, DiliTrust offers secure, intuitive solutions designed specifically for legal departments and governance professionals. Our Contract Lifecycle Management module provides the tools needed to implement efficient review processes while maintaining the highest standards of compliance and security.Ready to transform your contract review process? Discover how DiliTrust can help your organization implement an effective contract review checklist and streamline your entire contract management workflow. Book a demo today!