Contract compliance audits systematically review agreements to verify obligations, recover lost value, and mitigate risk. Regular audits—especially when supported by technology—help organizations optimize vendor relationships, improve processes, and proactively address legal vulnerabilities, turning compliance into a strategic asset.

Contract compliance audits serve as critical tools for organizations seeking to verify adherence to contractual terms, identify financial recovery opportunities, and mitigate risks. As businesses navigate increasingly complex regulatory environments, understanding how to effectively implement these audits becomes essential for maintaining strong vendor relationships and protecting company interests.

What Is a Contract Compliance Audit?

A contract compliance audit is a systematic examination of agreements between a company and its vendors, suppliers, or other business partners to determine if all parties are fulfilling their contractual obligations. This process involves reviewing contract terms, analyzing performance data, and identifying any discrepancies between what was promised and what was delivered.

These audits typically focus on financial aspects such as pricing, discounts, and rebates, but also extend to non-financial elements including service levels, delivery timelines, and quality standards. The scope depends on the organization’s objectives, which might range from recovering overpayments to improving future contract negotiations.

Contract compliance audits differ from general financial audits because they concentrate specifically on contractual relationships rather than overall financial health. They require specialized knowledge of contract law, industry standards, and business operations to be effective.

The Importance of Contract Compliance Audits

Organizations across industries benefit from regular contract compliance audits for several compelling reasons. First, these reviews help identify and recover lost revenue through overbilling, missed discounts, or incorrect pricing. For large enterprises with numerous vendor relationships, these savings often represent significant capital that directly impacts the bottom line.

Beyond financial recovery, compliance audits strengthen risk management by uncovering potential legal vulnerabilities before they escalate into costly disputes. They also provide valuable insights into vendor performance, enabling procurement teams to make data-driven decisions about future partnerships.

Additionally, contract compliance audits improve internal processes by highlighting inefficiencies in contract management. When companies identify recurring issues across multiple agreements, they gain opportunities to implement systemic improvements that prevent future problems.

Key Steps in the Contract Compliance Audit Process

Performing an effective contract compliance audit requires a structured approach.

Planning and Preparation

The audit team begins by defining clear objectives, determining the scope of contracts to review, and establishing a timeline. This phase also involves assembling the right team members with appropriate expertise in procurement, finance, and legal matters.

Document Collection and Review

Next, auditors gather all relevant documentation, including the original contracts, amendments, invoices, payment records, and performance reports. This information forms the foundation for the analysis phase.

Analysis and Testing

During this critical stage, auditors compare contractual terms against actual performance data. They review pricing structures, verify calculations, and check for adherence to service level agreements. This analysis often reveals discrepancies that require further investigation.

- Pricing verification: Comparing invoiced amounts against contracted rates to identify overcharges

- Discount validation: Ensuring all negotiated discounts were properly applied

- Performance evaluation: Assessing whether vendors met quality and delivery requirements

Reporting and Recommendations

The final step involves documenting findings, quantifying financial impacts, and developing recommendations for improvement. A comprehensive report provides management with actionable insights to recover costs and enhance future contract management practices.

Benefits of Regular Contract Compliance Audits

Organizations that implement regular contract compliance audits experience numerous advantages that extend beyond immediate cost recovery.

Financial Benefits

The most obvious benefit is the identification of overcharges, missed discounts, and billing errors that lead to direct cost savings. Many companies report recovering between 2–5% of contract value through audit findings, representing substantial amounts for large-scale agreements.

Operational Improvements

Audits frequently uncover process inefficiencies that, when addressed, lead to better contract management. These improvements streamline workflows, reduce administrative burden, and allow teams to focus on strategic activities rather than correcting errors.

Enhanced Vendor Relationships

Although vendors might initially view audits with apprehension, transparent audit processes actually strengthen business relationships by establishing clear expectations and accountability. When both parties understand performance standards, they work more effectively together.

Risk Mitigation

By identifying areas of non-compliance early, organizations address potential legal and regulatory issues before they escalate. This proactive approach minimizes exposure to penalties, litigation, and reputational damage.

Modern AI tools such as DiliTrust’s Risk Detector enhance contract compliance by automatically identifying high-risk clauses and deviations from internal standards. By applying custom playbooks to analyze contracts, Risk Detector flags potential legal vulnerabilities early, streamlining legal review and reducing human error. This proactive, AI-driven approach strengthens risk mitigation strategies by ensuring contractual obligations are clearly understood, consistently enforced, and aligned with company policies.

Common Challenges in Contract Compliance Auditing

Despite their value, contract compliance audits present several challenges for organizations to overcome.

Resource Constraints

Many companies lack internal expertise to perform thorough compliance audits, particularly for complex agreements in specialized industries. Limited staff availability also makes it difficult to conduct regular reviews across all vendor relationships.

Data Access and Quality

Obtaining complete, accurate information represents another significant hurdle. Contract documentation might be scattered across departments, stored in different formats, or missing key details necessary for proper analysis.

Vendor Resistance

Some suppliers resist audit efforts by delaying information requests or providing incomplete data. Overcoming this resistance requires diplomatic communication about audit objectives and contractual audit rights.

Best Practices for Effective Contract Compliance Audits

To maximize the value of compliance audits, organizations should follow these proven practices.

Establish Clear Audit Rights

When negotiating contracts, include specific language about audit rights, including scope, frequency, and access to information. These provisions create transparency and set expectations from the beginning of the relationship.

Implement Regular Audit Schedules

Rather than conducting audits only when problems arise, establish a regular schedule based on contract value, complexity, and risk. This approach normalizes the audit process and makes it a standard business practice.

Focus on High-Value Contracts

Since resources are limited, prioritize agreements with the greatest potential impact. Contracts with complex pricing structures, significant spending, or previous compliance issues warrant closer attention.

- High-dollar agreements with substantial financial exposure

- Contracts with intricate pricing or discount structures

- Relationships with vendors who have historical compliance issues

Document Findings Thoroughly

Maintain detailed records of audit processes, findings, and resolutions. This documentation provides valuable reference for future audits and helps identify patterns across multiple vendor relationships.

Leveraging Technology for Contract Compliance

Modern technology solutions transform the contract compliance audit process, making it more efficient and effective. Specialized software centralizes contract information, automates analysis, and provides real-time monitoring capabilities.

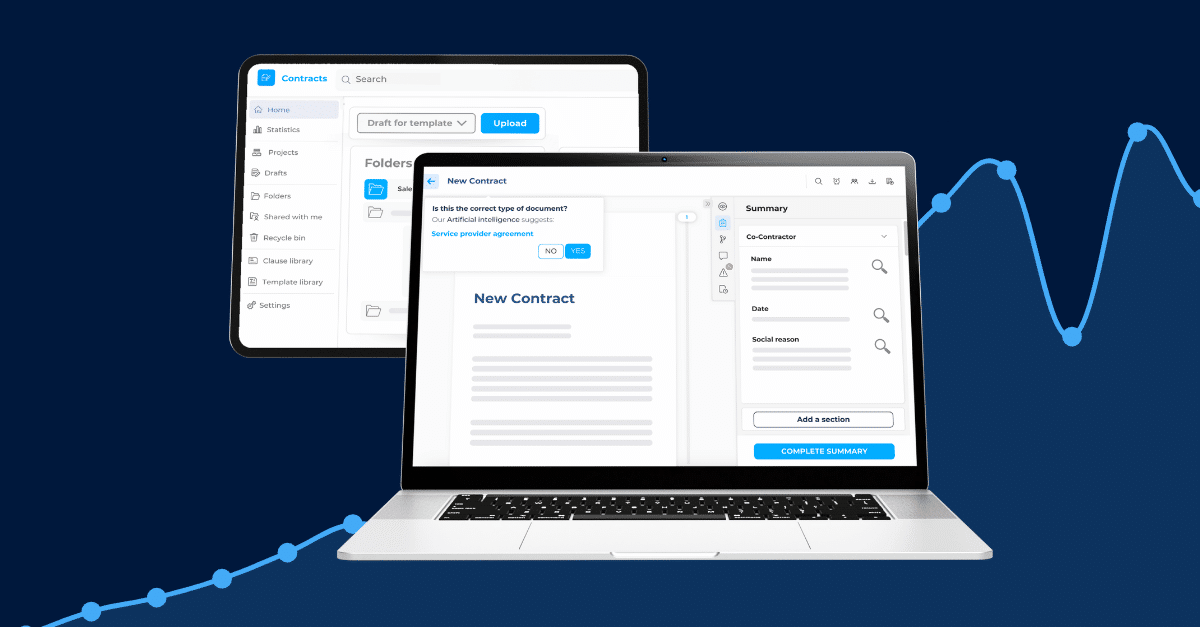

Contract Management Systems

Dedicated contract management platforms store agreements in a central repository, making them easily accessible for audit purposes. These systems track key dates, obligations, and amendments, providing a complete picture of contractual relationships.

Data Analytics Tools

Advanced analytics identify patterns and anomalies across large datasets, flagging potential compliance issues for further investigation. These tools detect subtle discrepancies that might otherwise go unnoticed in manual reviews.

Automated Monitoring

Rather than relying solely on periodic audits, automated solutions continuously monitor contract performance, alerting teams to potential issues as they arise. This ongoing oversight enables organizations to address problems promptly rather than discovering them months later.

The Role of Specialized Governance Solutions

Comprehensive governance platforms like The DiliTrust Suite provide integrated tools specifically designed for contract management and compliance. These solutions offer secure document storage, workflow automation, and reporting capabilities that streamline the entire contract lifecycle.

The Contract Lifecycle Management (CLM) module within such platforms enables organizations to maintain complete visibility into contractual obligations, making compliance audits more efficient and effective. By centralizing all contract information in a secure environment, companies reduce the time and resources required for audit preparation while improving accuracy.

Strategic Takeaways for Smarter Compliance

Contract compliance audits represent a powerful tool for organizations seeking to optimize vendor relationships, recover costs, and mitigate risks. Through systematic review of contractual obligations and actual performance, companies identify opportunities for financial recovery and process improvement that directly impact the bottom line.

By implementing a structured audit approach, leveraging appropriate technology, and following industry best practices, organizations transform contract compliance from a reactive exercise into a strategic advantage. The insights gained through regular audits not only recover immediate costs but also inform better contract negotiation, vendor management, and risk mitigation strategies for the future.

For businesses looking to enhance their contract governance capabilities, investing in specialized solutions provides the foundation for effective compliance management across the entire contract lifecycle. Ready to take the next step? Book a meeting with us today to discover how DiliTrust CLM can be tailored to your organization’s needs and drive your contract management success.