Legal departments today face a common, persistent challenge: critical contract and entity data lives in siloes. What does this mean? In many cases contract and entity data are stored separetaly and in different systems. This is mainly due to the fact that whatever tools are in use, the CLM and ELM don’t integrate to each other.

What happens next? This approach is not only inefficient but also risky. The bigger the company, the higher the risks. In global corporate environments, the cost of signing contracts without

up-to-date entity insights can be significant. From missed renewal deadlines to unauthorized signatories, the consequences can range from financial penalties to reputational damage.

Above all, these risks are not caused by negligence, but by the lack of a unified view of legal operations. When data doesn’t move in sync, mistakes become inevitable, and expensive.

When contracts and entity data don’t align: real consequences

There are many potential risks to working with unstructured contract and entity data. In this first section we’ll explore some of the common consequences that can apply to any global company.

Unauthorized signatures: a cautionary tale

One of the most common and costly mistakes seen in legal operations involves unauthorized contract signatures. For example, imagine a regional manager signs a contract worth €2 million. According to company policy, two joint signatories are required for any contract exceeding €1 million. However, this contract was signed by a single individual, someone who lacked any formal authority.

As a result, legal teams go into damage control mode. Emails are sent across multiple departments. Delegation records are tracked down from various locations. And the vendor—concerned about the legitimacy of the agreement, threatens legal action and late fees.

In this case, the lack of integration between contract and entity data allowed the problem to occur. If signatory rights had been checked in real time against the appropriate delegation rules, the issue would’ve been flagged before the agreement was signed. Instead, fragmented systems led to oversight, and avoidable legal and financial exposure.

Another common scenario involves the quiet auto-renewal of contracts under outdated conditions. Consider a technology service agreement with an automatic three-year renewal clause. The signatory listed on the original document left the company a year ago, and their power of attorney had long since expired. Yet, the contract renewed automatically, no renegotiation, no adjustments, no updated sign-off.

By the time the legal team discovered the issue, the company was locked into a legacy agreement with inflated costs and no exit clause. Once again, the underlying issue was the separation of contract and entity data, no system was in place to alert stakeholders to the expired authority or prompt a review before the renewal deadline.

Due diligence delays during financial transactions

This is perhaps one of the worst nightmares for in-house legal professionals. Due diligence is a core process taken for many transactions, such as a merger and acquisition. On one side, it’s important to have a good contract organization for financial transactions in order to easily trace back signatures, risky clauses and more. Nevertheless, this is not sufficient.

Picture a cross-border merger, a company needs to rapidly produce evidence of entity structures, signatory powers, and all related contracts. However, because the contract records and entity data are housed in separate systems, there’s no clear line of validation between the signatories of the contracts and their legal authority at the time of signing.

This causes significant delays and demands extensive manual research from legal teams. Not only will the overall operation be postponed, but valuable human resources will be diverted from other urgent priorities. By contrast, integrated data enables fast, confident responses to regulatory demands and ensures that M&A activities proceed without disruption from governance gaps.

Why integration matters

Integration between contract and entity data is more than a technological improvement and a source of efficiency. It can drastically change the risk management strategy of a company.

When these two types of data operate in isolation, legal departments are left in a reactive posture. They respond to crises, rather than preventing them. They conduct audits retroactively, rather than building compliance directly into workflows. This is not sustainable for companies operating at scale or across multiple jurisdictions.

Creating a legal source of truth

Integrated systems allow for a shared, real-time understanding of legal authority. This means that before a contract is signed, the system checks whether the individual has the right to act on behalf of the entity in question. Likewise, contracts tied to specific dates, like renewal or expiration, can be flagged well in advance, based on up-to-date entity insights.

With integration, there is no need to duplicate information across platforms. Delegation of authority rules live within the same environment where contracts are created and managed. This reduces the margin of error, enhances accountability, and allows for a much faster contract lifecycle.

Supporting strategic legal operations

The benefit of integration extends far beyond avoiding errors. It creates space for legal teams to become more strategic. Instead of investing time in manual checks or redundant data entry, teams can focus on reviewing key terms, advising business units, and monitoring for regulatory shifts.

Additionally, integration brings transparency. Audit trails are stored automatically, signatory right changes reflected across all relevant contracts in real time… and more. By enabling such easy communication between data sets, internal processes are simplified and audit ready all the time.

A framework that grows with complexity

Entities aren’t static. What it means is that as companies grow organically or through acquisition, the number of legal entities increases. So does the volume of contracts, jurisdictions, and governance rules. Without integration, each new layer adds complexity but with integration, scaling becomes manageable.

In this context, integrated contract and entity data systems provide a framework that supports expansion without increasing risk. Delegation structures can be applied consistently. Policies can be enforced globally. And compliance requirements can be addressed proactively, not after the fact.

What to consider during the integration implementation

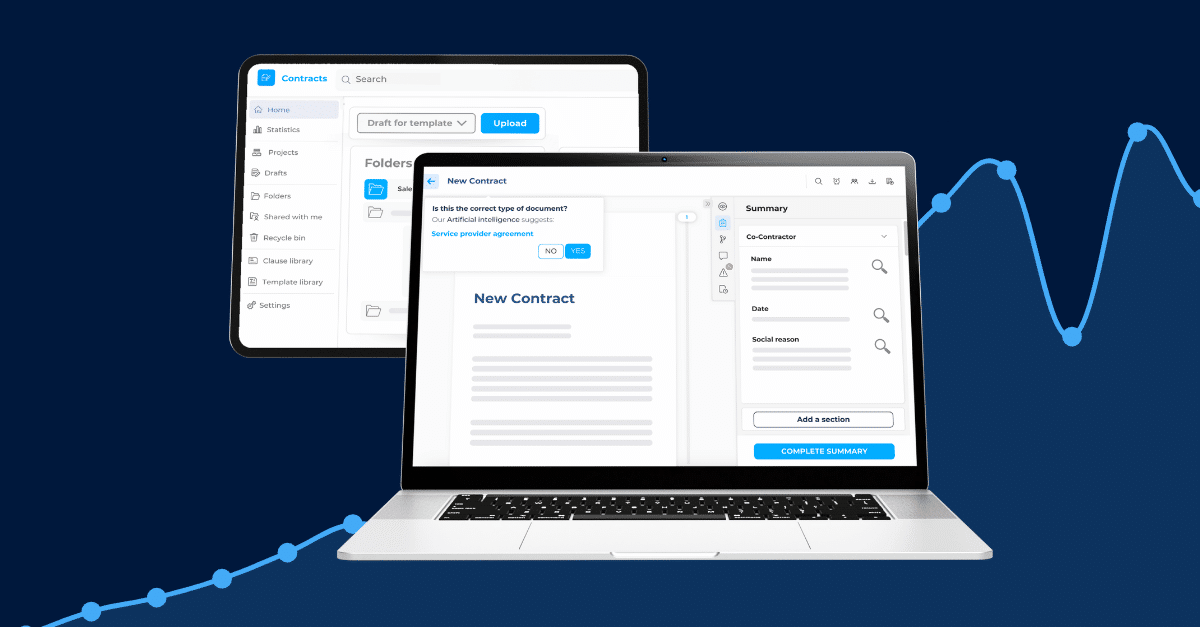

Transitioning to an integrated model doesn’t necessarily mean abandoning existing tools. Many organizations start by identifying the key data points that need to be shared between their CLM (Contract Lifecycle Management) and LEM (Legal Entity Management) systems.

Once those touch points are clear, APIs or middleware can enable automated synchronization. For example, when a new power of attorney is granted or revoked in the LEM system, that change should automatically inform the contract approval process. Similarly, when a high-value contract is initiated, the system should reference the latest delegation rules to determine the appropriate signatories.

The best option is to choose tools that can easily integrate from the start. This will allow a seamless process of integration and automatic communication between systems. Such is the case with the DiliTrust suite that can easily connect its CLM and LEM software.

For legal teams looking to drive adoption internally, it’s critical to highlight how integration reduces manual tasks, protects against liability, and supports broader business goals. Legal is about enabling secure, strategic growth, besides managing risk of course.

Don’t wait until it’s too late to connect contract and entity data

Disconnected systems breed blind spots. Whether it’s an expired power of attorney, an unauthorized signatory, or a missed renewal deadline, the cost of fragmented legal operations is high—and entirely avoidable.

By integrating contract and entity data, organizations gain clarity, efficiency, and control. Legal teams become proactive stewards of governance rather than responders to preventable crises. Authority is no longer assumed, it’s verified. Signatures are no longer symbolic, they’re compliant. And contracts are no longer risky, they’re reliable.

Integration is not just a technical upgrade. It’s a new standard for legal operations, one that is fast becoming a business imperative.

Curious about what DiliTrust can do to help? Contact our DiliTrust team today and see our Suite in action.