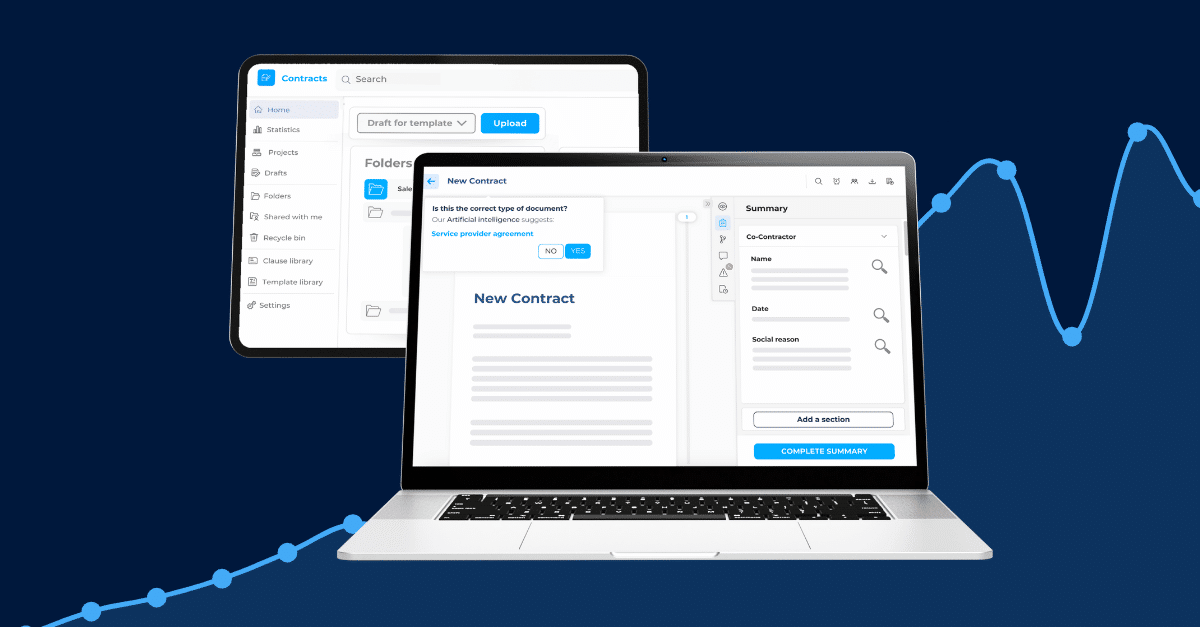

It is no secret that time is often scarce for legal teams. With never ending piles of contracts to review, over-dependency on legal teams tends to slow processes, and revenue. So to fix it, a lot of LegalTech tools such as CLMs, are adding a useful feature: automated contract risk detection.

The pressure to review faster is shifting contract management, automated risk detection doesn’t replace human judgement. It simply makes it easier to apply such judgement across high volumes of contracts faster.

In this article we uncover four real-life use cases that’ll convince you to go from manual to automated.

Due Diligence for Mergers and Acquisitions

Timing is everything in mergers and acquisitions, deals move fast and legal teams are expected to keep up with it. The challenge in this type of transaction is that due diligence often involves hundreds of documents, and parties whether external or internal. On top of the high volume of documentation to review, is the fact that each contract has its own obligations, terms and specificities.

This delicate process usually requires a seasoned team of legal experts to go over each clause and contract.

How automated risk detection can help:

As a result, legal teams can move faster in the due diligence process and help organizations close deals on time.

Service Providers and Liability Clauses

With pressure mounting to work faster and better, some legal departments enlist external service providers for help. Let’s take example of a pharmaceutical company with limited internal legal resources preparing for an important audit. Relying on an external service is a great solution, but the subtle wording in a contract can potentially lead to serious consequences.

Indeed, responsibility and limitation of liability clauses are often the “small print”. Add to the challenge that manual review of such contracts leads to higher risks of inconsistencies…

The benefits of automated risk detection:

But it goes further. Automated risk detection can ease contract review in many other sectors usually containing high liability risks, such as leasing agreements.

ESG Clauses and Sustainability in the Energy Sector

Some industries such as the energy sector are under higher pressure to comply with sustainability clauses. In addition, for organizations with sustainability commitments, contracts are an extension of corporate policy. The thing is, when it comes to ESG and CSR simply having the clause in the contract is not enough. Organizations must ensure such clauses reflect the values and standing of the company, and here’s where the challenge lies.

Manually reviewing whether the clauses comply with the company and regulatory standards isn’t an option. Specially when timelines to comply are short…

Through automated risk detection teams can:

Automated risk detection in contracts gives more than time, it gives peace of mind for such a time sensitive working environment.

For Procurement and Business Departments

One of the (many) challenges legal teams face with contracts is the lack of centralization. Believe it or not, contract managers and legal professionals aren’t always the first to handle contracts. In many companies, it’s actually procurement or sales that initiate the process.

Where does the problem lie? These departments often don’t share the same legal understanding of contracts. The result is either operational delays, when every contract is routed to Legal, or increased risk exposure, when some contracts are not. In either case, the outcome is far from optimal.

The impact of automated risk detection:

Automated risk detection enables all relevant teams to accelerate contract workflows while maintaining full compliance.

Automated Risk Detection is Here to Stay

The ultimate goal for many legal leaders is to operate proactively rather than reactively. When contracts begin on a solid foundation, every subsequent stage becomes more efficient, from closing and edits to re-negotiations, with fewer compliance risks. Automated risk detection fosters this proactive approach, enabling teams to scale their operations safely and with greater ease.

If your organization has a history of resisting change, rest assured that the human touch remains essential. CLMs with contractual risk detection typically operate based on predetermined guidelines, often referred to as contract playbooks.

A tool will never replace legal expertise. It enhances it. Discover how automated risk detection can strengthen your team’s capabilities and safeguard every contract.