Having contracts organized is a critical component of effective business management no matter your industry. When it comes to financial transactions though, its importance is really high because whether it’s for an acquisition or an investment round, whoever is looking at your company will want to look at your contracts. In this article we’ll dive into the relevance of a robust contract strategy for financial transactions. Of course, we’ll share some tips on how to do it right.

Contract organization for financial transactions – a key component

At its core, contract organization refers to the meticulous management, categorization, and storage of contractual agreements within a company. This includes everything from shareholder agreements, non-disclosure agreements, and licensing contracts, to more complex financing agreements. As companies undergo financial transactions, having these contracts well-organized ensures that all key stakeholders—whether investors, legal teams, or M&A professionals—have quick access to accurate, up-to-date information.

In the context of financial transactions, particularly in M&A deals and investment rounds, organization goes beyond mere document storage. Investors, legal teams, and other parties involved in these transactions rely on organized contracts to assess potential risks, ensure compliance, and verify the company’s legal standing. It’s critical that every contract is easy to locate, properly classified, and reflects the current status of the relationship it governs. Having this system in place is vital to avoid legal surprises that can delay or derail the transaction process.

What does contract organization has to do with financial transactions

The significance of organized contracts in financial transactions, such as mergers and acquisitions (M&A) and investment rounds, cannot be overstated. In these high-stakes scenarios, parties involved scrutinize the finer details of every document to ensure accuracy and mitigate risks. Below, we explore the role of contract organization in these financial transactions.

Role of contracts during M&A

Mergers and acquisitions are complex transactions that require detailed due diligence. During an M&A, both parties need to assess each other’s contractual obligations and legal positions. Disorganized or incomplete contracts can lead to significant delays in this process. Imagine a situation where the buyer discovers incomplete or conflicting clauses in a contract right before closing—this could be disastrous.

For the acquirer, organized contracts provide clarity regarding the company’s liabilities, assets, intellectual property rights, and ongoing obligations. Investors, on the other hand, need to ensure that no hidden liabilities or unaddressed legal issues could impact the valuation of the business. Furthermore, post-acquisition integration often involves dealing with numerous contracts, such as vendor agreements or employee contracts. Having these contracts well-organized ensures smooth transitions and mitigates risks.

During the due diligence phase of an M&A deal, both parties will examine the target company’s contracts to verify the completeness and validity of the agreements in place. This could include customer contracts, supplier agreements, or partnership arrangements. Disorganized contracts can lead to missed opportunities or even financial liabilities if not properly assessed. An organized contract repository enables quick, easy access to these crucial documents, allowing for a more efficient and thorough due diligence process.

Role of contracts for an investment round

In investment rounds, be it venture capital or private equity, investors place considerable emphasis on understanding the legal framework of the company they are considering. Investors typically want to review the company’s contracts to assess the risks and obligations they may inherit through their investment. Well-organized contracts allow for efficient and accurate legal review, helping investors make informed decisions.

Investors may request a variety of contracts, such as founding documents, shareholder agreements, intellectual property rights, and customer contracts. These documents must be readily available and easy to navigate to avoid delays in the investment process. Furthermore, a clean, organized record of contracts signals professionalism and instills confidence in investors.

Additionally, as investment rounds typically involve negotiations regarding the terms and conditions of the deal, organized contracts ensure that all prior agreements are aligned and that there are no hidden conflicts of interest that could raise red flags. A streamlined contract organization system can improve trust between the company and its investors, ultimately aiding in the smooth flow of funds and the closing of the investment round.

Advice to keep your contracts in order at all times

Legal professionals play a pivotal role in setting up and maintaining the systems that allow an ordered contract strategy. One of the main goals when it comes to financial transactions is to allow external and internal parties an efficient due diligence review. Let’s explore some ways to do it.

Team-up with the right partners and tools

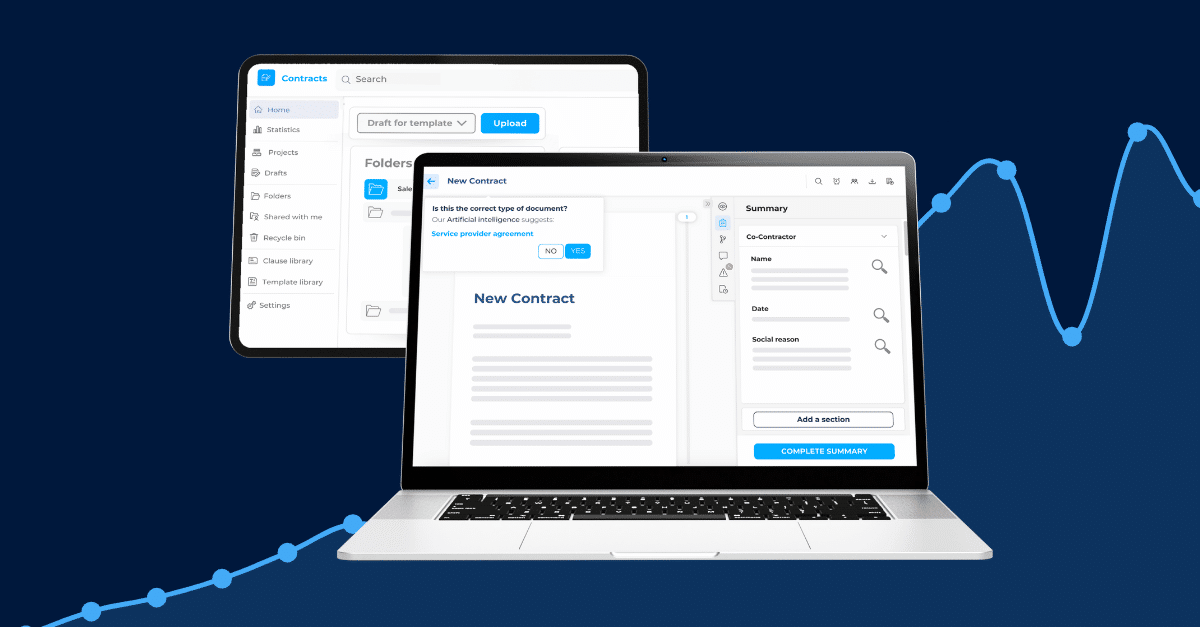

As you’ve likely realized by now, relying on manual systems for contract management is no longer feasible. There are various solutions available that offer automation, AI-powered insights, and features that ultimately streamline operations during crucial financial transactions. A dedicated contract management tool, such as the DiliTrust CLM, ensures your contracts are well-managed and readily accessible whenever needed.

DiliTrust provides a centralized platform that helps organize contracts with advanced search capabilities, classification features, and version control. The right tools also help ensure compliance by automatically alerting teams to renewal dates, deadlines, or any changes to contractual obligations, which can be critical during M&A or investment negotiations.

Templates, classification and order

Of course your chosen tool will do miracles to help keep your contract library clean. Nevertheless, you’ll still need to do some organizational work in collaboration with other teams or users of the platform. We recommend following some tips, to allow an easy access for due diligence when important transactions come up.

Make sure each contract is appropriately tagged with essential details, such as the start date, expiration dates, parties involved, and jurisdiction. Beyond maintaining structured contracts, the goal is to enable fast searches and efficient history tracking. This is especially important for investors, who will likely conduct contract audits during funding rounds. In the end, well-organized contracts will make it easier for internal teams and external parties to access and understand the documents.

Creating an organized filing system will significantly improve the efficiency of due diligence and any financial transaction processes. With everything neatly categorized, legal professionals and investors can easily find the documents they need without wasting time sifting through unorganized files.

Don’t wait for an important transaction to come up, start today

Organized contracts are not just a luxury; they are essential for successful financial transactions, including mergers and acquisitions and investment rounds. Investors and M&A professionals rely heavily on clear, accessible contracts to assess potential risks and validate the terms of a deal.

By implementing best practices for contract organization, companies can streamline their legal processes, mitigate risks, and ultimately facilitate better financial outcomes.