Side letters are confidential agreements that customize fund terms for specific investors—making strong legal and compliance oversight essential.

Key Insights

- Tailored rights like MFNs, fee breaks, co-investment options

- Rising complexity calls for better tracking and governance

- Legal teams must ensure enforceability and alignment with fund terms

- Centralized CLM systems reduce risk and streamline oversigh

What is a side letter?

A side letter is is a confidential agreement that modifies or add to the initial terms of limited partnership agreements. It extends to other subscription documents in the private equity and venture capital world.

Although side letter agreements aren’t all new, they have gained popularity in recent years. Just like continuation funds, this is due to the rising complexity of investor demands and changes in fund structure. As a result, side letters are also more scrutinized leading compliance and legal experts in private equity to a sharper focus on such agreements.

Getting the basics

A side letter aims to provide individual investors with rights and/or obligations that differ from the original agreement. What does that look like in an agreement? It can be tax accommodations, co-investment opportunities, fee breaks, or things such as specific reporting requirements.

Side letter documents can vary a lot depending on the limited partner, region, industry and other criteria. Nevertheless, there are some classic clauses you may find on repeat.

Common side letter clauses

Among the many side letter clauses private equity uses, there are some frequent ones. Emerging clauses have appeared in risen in popularity too, but the classic ones include:

Most Favored Nations

In short, an MFN clause is a promise from a private equity fund to treat certain investors equally. The idea is that if one investor negotiates favorable terms in their side letter, others with MFN rights can access those same terms, though not all MFNs are created equal. These rights typically allow eligible investors to review the side letter provisions granted to others and select which ones they’d like to apply to themselves. Although they’re widely used and demanded, they carry complexities. MFN scopes can vary, : some may only cover economic benefits like fee discounts, while others are limited to investors who commit the same or greater amounts of capital.

Transfer Rights

As its name indicates, this clause enables investors to transfer their investment to other investors before the fund ends. This is typical for transactions within closed-ended funds (which lock in investments for a determined period of time). It sounds easy, but it can be more delicate, since fund managers will generally want to know who the investment is being transferred to. In that sense, some investors may not pass essential security checks, such as anti-money laundering audits.

Fee discounts

Fee discount clauses have become quite common. Fund managers offer certain financial advantages to select investors, with the ultimate goal of bringing them on board with a project. Management fee discounts are the most common, but investors can also negotiate better terms regarding the fund’s performance bonuses. The latter is less frequent but is a benefit many look for. These clauses typically apply to specific types of investors: early birds (who invest from the very start); repeat investors (who backed the manager’s last fund and commit to the next one); big investors (who commit large amounts into one or multiple funds); and strategic partners (with whom managers want to build long-term relationships).

Co-investment Rights

Co-investment rights are a newer clause category, as more investors look for ways to invest with private equity funds rather than just through them. In practice, limited partners often ask the fund manager to notify them when a co-investment opportunity arises and negotiate other perks alongside. Usually, longstanding partners (LPs that have invested with the fund over time) get the best deals, for instance, they might request to be informed first about new co-investment opportunities or negotiate lower fees. In either case, all the details must be written in the side letter.

These side letter terms all sound very attractive, as they all enable a better opportunity for greater returns on investment. As some of the above clauses become more and more the norm, legal and compliance teams in private equity organizations must keep in mind the challenges that come along.

Compliance and Legal Challenges

Key Legal and Compliance Considerations

One of the most significant challenges with side letters is ensuring enforceability. Side letters must not contradict the LPA or violate fiduciary duties to the fund or other LPs… here’s where internal teams must be diligent when reviewing the clauses of their partners, because what may be good for one, can be bad for another. Moreover, certain terms such as MFNs imply that one investor’s concessions, can trigger similar rights for others. Ultimately, this increases the compliance load since PEs will want to also look at what’s best for their fund.

If a side letter is too distant from certain standard fund terms, it could undermine governance and investor trust. These documents are confidential by nature (without considering MFns), yet they can influence major fund decisions whilst being hidden away from LPs. By nature they can also lead to legal disputes, which is why fund counsel, legal counsel, and compliance, must balance tailored agreements with fairness and transparency.

Operational Challenges

The administrative burden of managing multiple, often inconsistent side letters is substantial. Legal and compliance teams must ensure all obligations are catalogued, monitored, and fulfilled. Failure to do so can result in breach of contract, regulatory violations, and reputational harm.

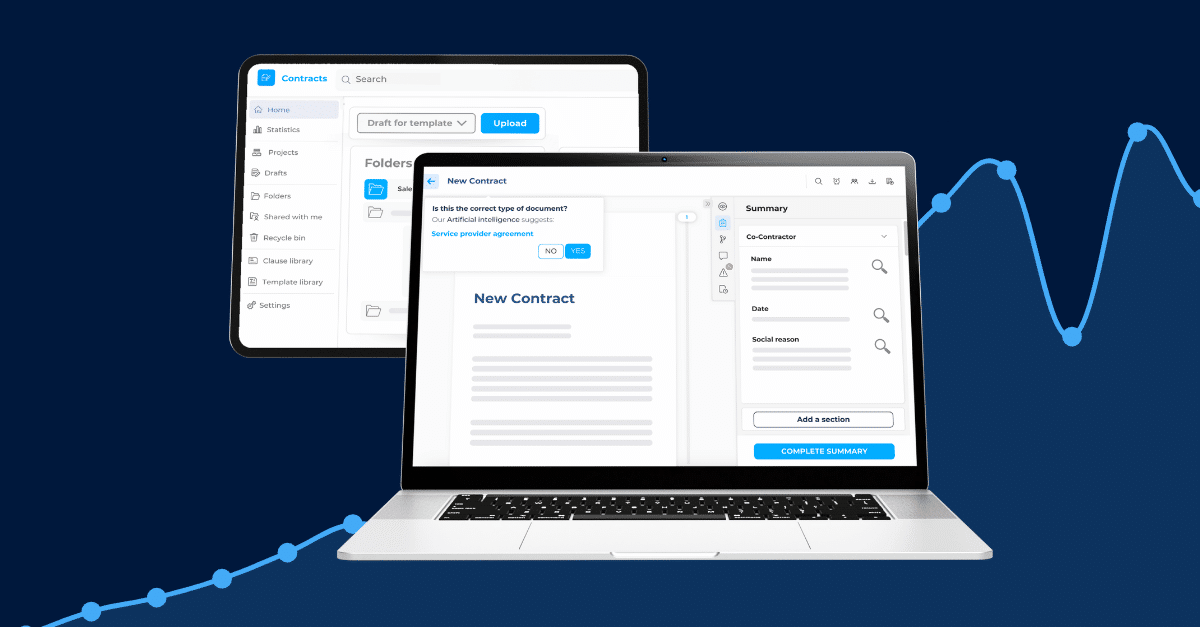

Manual tracking methods, such as spreadsheets or binders, are still common but increasingly inadequate given the volume and complexity of side letters. Legal teams are encouraged to adopt centralized systems and structured processes to track obligations and MFN elections.

Best Practices for Legal Teams

- Centralize Documentation: Maintain a centralized repository of all side letters with version control and access protocols.

- Standardize Review Processes: Use consistent checklists and legal templates to evaluate new side letters.

- Audit Regularly: Conduct periodic audits of compliance with side letter obligations.

- Align with Fund Documents: Cross-check side letters against LPAs and governance documents to avoid conflicts.

- Prepare for MFN Elections: Clearly map out MFN-triggered terms and prepare controlled disclosure lists in advance.

Conclusion

Side letters have become an indispensable component of private equity and venture capital fund management. As the volume and intricacy of these agreements grow, legal and compliance teams must adopt structured, technology-supported strategies to manage their obligations effectively. By doing so, they can reduce legal risk, maintain fairness among investors, and support the fund’s strategic and operational goals.

Up your game with DiliTrust CLM, centralize and keep full control of your side letters.